Using Itemized Deductions on Income Tax Return

My Internet connection is back after two (2) straight days without it. How I was able to have it back is another story. For now, let me tackle the other method of deducting your expenses in running a ... read more

Computation of 2008 Income Tax Using OSD

Let us now compute the income tax of an i-café owner for the gross sales he had for 2008 using the Optional Standard Deduction (OSD) as provided for under Republic Act No. 9504 and its implementing rules and ... read more

Can Gaming I-Cafés Be Charged With Amusement Tax?

Hey, this topic can be very controversial and not pleasant to the ears of most i-café owners but we have to face the fact that some bright local legislators (councilors in the common parlance) may soon think about ... read more

Classifying Games That Minors Play in Cafes

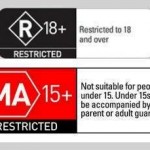

While other countries like the USA, Australia, New Zealand and the European countries have long been classifying the games being sold in their territories and played by their citizens, I have yet to hear our national legislators talk ... read more

The 2009 PAPT Anti-Piracy Campaign

The Pilipinas Anti-Piracy Team (PAPT) has launched its 2009 Anti-Piracy Campaign with the slogan “Legalize Your Software Now – Don’t Wait Until It’s Too Late.” This is actually the message that PAPT composed of National Bureau of Investigation ... read more

The Predictive vs. Declared Income of an I-Café

The Predictive Income Level (PIL) of an i-café is already discussed here in my blog and this one is a follow-up in view of issues regarding its use versus the income figure that an i-café owner declare in ... read more

Latest Feedbacks