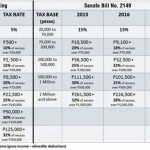

Taxing The Low-Income Salaried Pinoys

There are now various bills filed in both the House of Representatives and the Senate proposing the reduction of taxes being imposed on incomes of Filipinos belonging to middle class of our society. The discussions in this blog post ... read more

Paying Taxes The Easier Way

In my blog post about taxing the self-employed Pinoys, I mentioned about the time-consuming ways of filing and paying the dues by the taxpayers. While the fixed-income taxpayers are no longer required to file annual income tax returns ... read more

Taxing The Self-Employed Pinoys

The other day, I watched the live telecast of the 2011 State of the Nation Address (SONA) of our President Benigno S. Aquino III and among the many statistical figures he mentioned, it was the amount of taxes ... read more

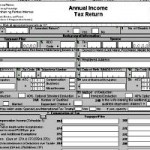

Filing Annual Income Tax Return

Most i-cafés are single-owned so their owners have to pay income taxes just like any individual. Deadline for filing and paying the tax for income earned in the past year is every April 15th of the succeeding year. ... read more

Corporate vs. Single Ownership of Cafés

During last month’s income taxation period, I came out with some blog articles about the allowable expenses in computing the income tax due on an individual taxpayer deriving income solely from business. There are two (2) methods of ... read more

The Need for CPA in Filing Income Tax Return

Whenever the topic of filing income tax return comes out, the question of whether the taxpayer will need the services of a Certified Public Accountant or CPA will always be asked in web forums and actual conversations. I ... read more

Latest Feedbacks