Tax Deductions On Salaries Of Employees

My blog post on taxing the low-income salaried Pinoys elicited queries from readers asking if the tax deductions on their monthly salaries are correct. It is a well-known fact that taxes on salaries of employees constitute a big chunk of the revenues being collected by the Bureau of Internal Revenue (BIR) every year.

Add also the fact that it is the easiest to collect among the taxes being levied by the agency to various taxable transactions in the country and you could understand the BIR Commissioner’s opposition to lowering the percentages being imposed on various income brackets of daily and monthly paid employees. For a better understanding of this matter, read this new guide on how you read paystubs.

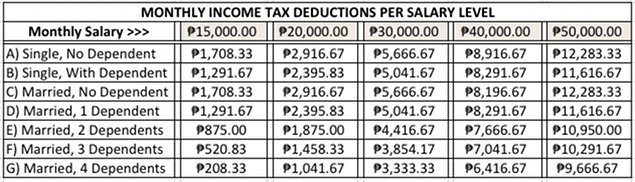

Anyway, our discussion this time is not about the proposed lowering of income tax of the middle income group which apparently is long overdue considering that it the current rates have remained unchanged since the 1990s. While many employees may be aware of how much are getting deducted on their salaries through the work time tracker some companies employ, quite a number of them may not know how those figures are computed. In an effort to present a better view of how their income taxes increase as their gross monthly salaries grow, below is a tabulation of monthly salaries of employees and their income tax deductions:

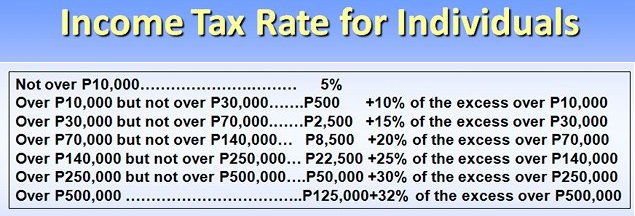

The above figures were computed using the current income tax rates for individuals (see below) and the personal exemption of ₱50,000.00 plus additional exemption of ₱25,000.00 per dependent up to maximum of four (4) only, as provided for in Republic Act No. 9504 enacted in mid-2008. For the gross annual income per salary level, the mandatory 13th month pay is added to the monthly salary multiplied by twelve (12) months. The income tax on bonuses in excess of ₱30,000.00 was also considered in the computations.

R. A. No. 9504 was the same law that granted income tax exemption to minimum wage earners which at the current ₱466.00 per day in Metro-Manila translate to around ₱12,000 per month. Take note that over and above the mandated minimum wage, an individual income will be subject to income tax. If say, an employee with single status and no dependent is hired with a daily wage of ₱470.00 and he works an average of 26 days a month, he will have a taxable income amounting to ₱96,640.00 so he needs to pay ₱13,828.00 to BIR. What a weird situation, isn’t it? That’s our taxation law and we have to live with it.

Latest Feedbacks