Filing Annual Income Tax Return

Most i-cafés are single-owned so their owners have to pay income taxes just like any individual. Deadline for filing and paying the tax for income earned in the past year is every April 15th of the succeeding year. While taxpayers are required to pay income taxes every quarter, it is the preparation and filing of annual income tax return (ITR) that matters most. As the deadline nears, you would see a lot of discussions about income taxation on web forums frequented not only by i-café owners but also by small businessmen who do not avail the services of bookkeepers and accountants. The statistics of this blog during this month of April show my previous articles about taxation as the ones with the most number of visits from readers who apparently want answers to their questions about the preparation of annual income tax returns.

Most i-cafés are single-owned so their owners have to pay income taxes just like any individual. Deadline for filing and paying the tax for income earned in the past year is every April 15th of the succeeding year. While taxpayers are required to pay income taxes every quarter, it is the preparation and filing of annual income tax return (ITR) that matters most. As the deadline nears, you would see a lot of discussions about income taxation on web forums frequented not only by i-café owners but also by small businessmen who do not avail the services of bookkeepers and accountants. The statistics of this blog during this month of April show my previous articles about taxation as the ones with the most number of visits from readers who apparently want answers to their questions about the preparation of annual income tax returns.

I can understand an i-café owner’s decision not to hire a capable bookkeeper in doing their book of accounts and tax documents but I am sorry to say that they cannot learn how to do them by just asking questions in forums. Bookkeeping and preparing paystubs are skills acquired by those who studied in schools so unless an i-café owner has such background, he cannot expect himself to do the bookkeeping for his business. This is something that i-café owners must accept and so with the fact that people who knows how to do it will not readily impart such knowledge on say, blogs and forums.

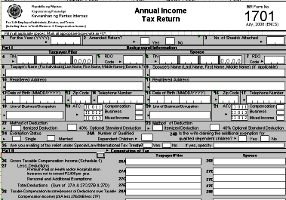

If you are one of those taxpayers who prefer to do your ITR, there is an available way for you to do it accurately. This is using the Optional Standard Deduction (OSD) in place of itemized deductions. Last year was a bit confusing for an income taxpayer to use OSD because it was made effective only on the second half of 2008. I had an article entitled Computation of 2008 Income Tax Using OSD to which I may refer you if you want to prepare your 2009 Annual ITR by yourself. The OSD method of preparing annual income tax return is very simple and easy to do but should you have questions about it, I am ready to answer them here.

We will run a series of articles about compliance to income taxation rules in the Philippines for i-café owners at The Income Tax Of An I-Café Business. The site contains i-café business tips as well as ways to comply to rules and regulations.

the worst thing for me is remembering to claim everything. otherwise i am just screwed!

san po ba ibabatay ung tax withheld i mean kapag inilagay dun sa itr BIR no.1700 san pu irerefer ung kung saan kinuha ung tax withheld tnx sana po masagot asap kelangan q pu kc ee

BIR Form No. 1700 is the Annual Income Tax Return for Individuals Earning Purely Compensation Income so it is not the one referred to in this article. However, to answer your question, tax withheld refers to the amount deducted from your salary by your employer. You can find it on BIR Form No. 2306 which should be given to you by your employer before January 31 of each year.